Living and Working in the Netherlands: How to read your Dutch payslip

Whether you’ve just started your job in the Netherlands or have been working here for a while, understanding your payslip is more important than you might think. Even if you trust your HR department to handle everything correctly, it’s still essential to know what you’re actually being paid, what deductions are made, and how things like holiday pay or taxes affect your net salary.

Dutch payslips can be quite detailed—and often overwhelming—especially if you’re not familiar with the language or local payroll terms. From “bruto” to “netto,” “loonheffing” to “vakantiegeld,” it can feel like you need a translator just to make sense of it all.

That’s where Coach4expats comes in. In this article, we’ll walk you through the structure of a typical Dutch payslip, breaking down each section step by step. With clear explanations and helpful visuals, you’ll be able to understand exactly what your payslip is telling you—no Dutch dictionary required.

What does a Dutch Payslip look like?

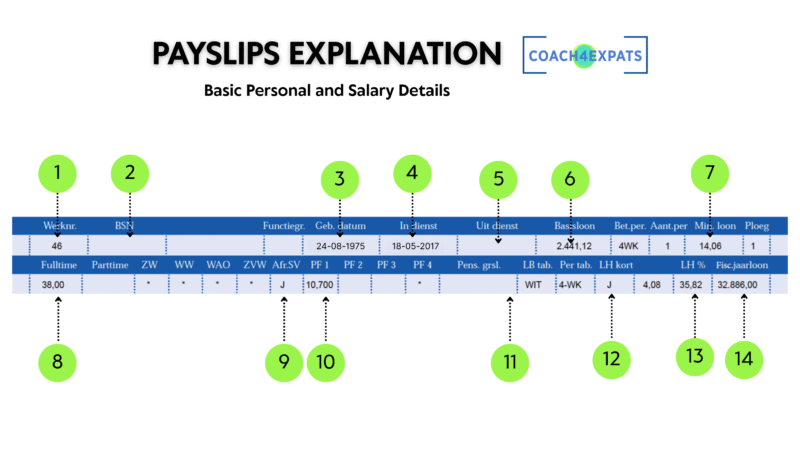

a. Basic Personal and Salary Details

In this first part, we’ll walk you through the top section of a typical Dutch payslip — where your personal information and basic salary details are listed.

Understanding these fields is crucial, as they set the foundation for how your salary, taxes, and social contributions are calculated.

We’ll explain each item clearly and show you where to find it on your payslip, so you know exactly what all those numbers and labels mean!

1. Werknummer (Employee Number)

This is your unique identification number within the company. It helps your employer track payroll, HR records, and administrative details linked to your employment.

2. BSN (Burgerservicenummer – Social Security Number)

Your BSN is a personal identification number issued by the Dutch government. It’s used for tax, healthcare, and social security purposes. Every resident in the Netherlands has one.

3. Geboortedatum (Date of Birth)

This shows your official date of birth. It’s important for verifying your identity and may also be relevant for determining tax rates, social contributions, and pension entitlements.

4. In dienst (Start Date)

The date you officially began working for the company. This is used to calculate your tenure, benefits eligibility, and sometimes holiday entitlements.

5. Uit dienst (End Date)

If applicable, this shows the date you ended your employment with the company. If you’re still employed, this field will usually be blank.

6. Basisloon (Base Salary)

Your gross monthly salary based on a full-time workweek. This amount does not yet include bonuses, overtime, or deductions like taxes and social security.

7. Minimaal Loon (Minimum Salary)

This refers to the legal minimum gross salary based on Dutch labor laws. It ensures that employees are paid at least the minimum wage for their age and working hours.

8. Full-timer (Full-time Workweek Indicator)

This indicates the standard number of hours for a full-time position at the company, typically 38 hours per week.

If you work full-time, the ‘Part-time’ field will be empty.

If you work part-time, this field will show the number of contract hours you are expected to work per week.

9. Afr. SV (Afrekenen Sociale Verzekeringspremies) (Ja) (Social Insurance Contributions – Yes)

This field shows whether your employer is calculating and paying your social security contributions (like unemployment and disability insurance). “Ja” (Yes) means these contributions are being deducted.

10. Pensioenfonds % (Pension Fund Percentage)

This shows the percentage of your salary that is contributed to a pension fund. It can be a combination of employee and employer contributions, ensuring savings for your retirement.

11. Loon Belasting Tabel (Wit) (Salary Tax Table – White)

Dutch payroll uses two tax tables: White (for active income like salaries) and Green (for other incomes like pensions or unemployment benefits). “Wit” indicates your salary is taxed under the White Table for regular employment.

12. Loonheffing Korting (Payroll Tax Credit – Yes or No)

Indicates whether the payroll tax credit (loonheffingskorting) is applied.

“Ja” (Yes): You are using your tax credit here, reducing the amount of income tax withheld.

“Nee” (No): No tax credit applied, which may happen if you have multiple employers.

13. Loonheffing % (Tax Percentage)

The percentage of your taxable income (gross salary minus certain deductions like pension contributions) that is withheld for income tax purposes.

14. Fiscaal Jaarloon (Fiscal Annual Salary)

This is the taxable salary from the previous year. It’s important because it determines the applicable tax rates, especially for bonuses and special payments (bijzondere beloningen).

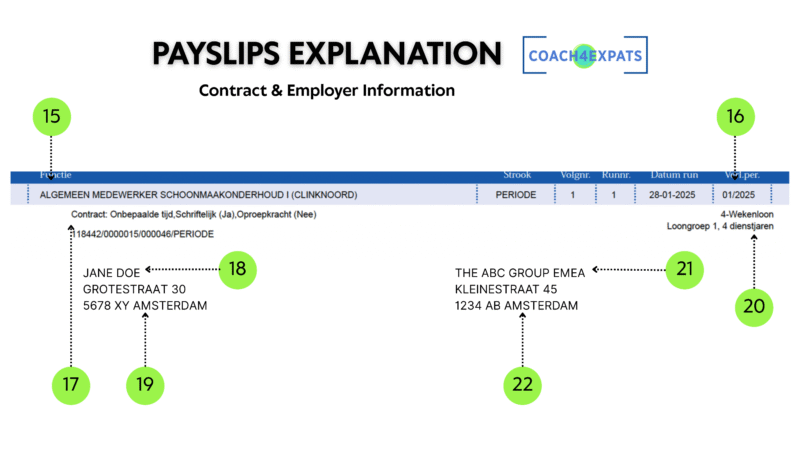

b. Contract & Employer Information

This part of your Dutch payslip outlines the basic administrative details of your employment—who you work for, your job title, the type of contract you hold, and the period this payslip covers.

It also includes your personal details as registered in the payroll system. Even though this section might seem straightforward, it’s important to check that everything here is correct, especially when you start a new job or change contract types.

15. Functie (Function / Job Title)

This indicates your official role or position within the company, as registered in the payroll system. It reflects the job title tied to your employment contract.

16. Periode (Period)

Shows the payroll period for which this payslip applies. It can be monthly, every four weeks, or biweekly—depending on your employer’s payroll cycle.

17. Contracttype (Contract Type)

Specifies the type of employment contract you have. Common examples include:

Vast contract (permanent contract)

Tijdelijk contract (temporary contract)

Oproepcontract (on-call contract)

Nulurencontract (zero-hour contract)

18. Naam werknemer (Employee’s Name)

Your full name as registered in the company’s payroll and HR systems.

19. Adres werknemer (Employee’s Address)

Your registered residential address. It’s used for official correspondence and sometimes relevant for travel allowance calculations.

20. 4-wekenloon (4-Week Wage)

If your salary is calculated on a 4-week basis instead of monthly, this shows your gross wage for that 4-week period. It’s often used in retail or hospitality sectors.

21. Werkgever (Employer)

The legal name of the company you work for. This could differ from the brand name or location you work at.

22. Adres werkgever (Employer’s Address)

The official address of your employer’s head office or legal entity, often required for tax and insurance records.

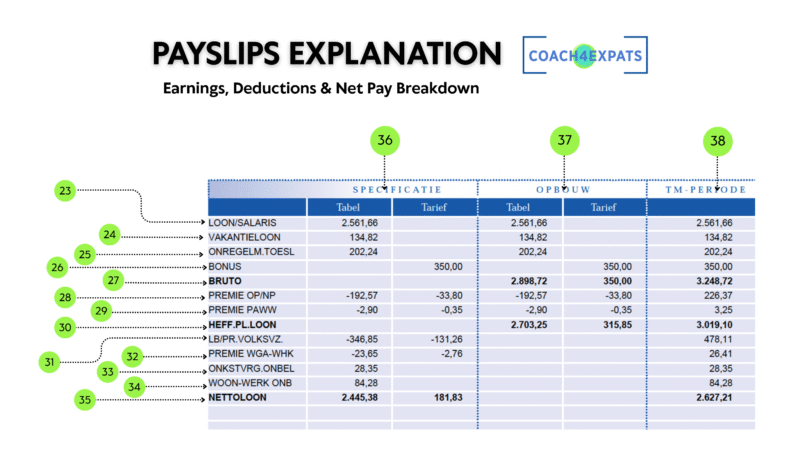

c. Earnings, Deductions & Net Pay Breakdown

This section of your payslip breaks down how your salary is calculated—from your gross earnings to the final net amount that hits your bank account. It includes details about vacation pay, pension contributions, tax deductions, and any non-taxable reimbursements you might receive.

Understanding these elements helps you see exactly where your money goes—and why your take-home pay may differ from your gross salary.

23. Loon/Salaris (Wage/Salary)

This is your gross salary for the current period before taxes and deductions. If you work part-time, it will be adjusted according to your contract hours.

24. Vacantieloon (Vacation Wages)

This shows any vacation pay accrued or paid out. In the Netherlands, vacation pay (usually 8% of your annual gross salary) is often paid out once a year or monthly.

25. Onregelmatige Toeslag (Non-Regular Allowance)

Additional pay for irregular work hours—like night shifts, weekends, or public holidays. This is often called “unsocial hours compensation.”

26. Bonus

27. Bruto (Gross)

Your total gross income for the period before any deductions—this includes your base salary and any bonuses or allowances.

28. Premie ON/NP (Pension Employee Contribution)

The portion of your salary that you contribute to your pension scheme. This is a mandatory deduction and reduces your taxable income.

29. Premie PAWW (Additional Pension Contribution)

A specific deduction for the Private Supplementary Unemployment Scheme (PAWW), which extends unemployment benefits beyond the standard period.

30. Heff. pl. loon (Taxable Salary)

The amount of income tax and national insurance contributions is calculated based on the taxable salary. This amount is withheld under the label “LB/PR.VOLKSVZ.” (Loonbelasting / Premie Volksverzekeringen – Income Tax / National Insurance Contributions).

31. Loonbelasting Volksverzekering (Payroll Tax & Social Security)

This line includes both income tax and national insurance contributions (for things like AOW – state pension, WLZ – long-term care, etc.).

32. Premie WGA (Insurance premium for partially disabled workers)

It helps fund benefits for employees who become partially incapacitated due to illness or disability but can still work to some extent.

33. Onbelaste Werkonkosten (Non-Taxable Employment Cost)

Reimbursements from your employer for work-related expenses (e.g., training, mobile phone use) that are not taxed.

34. Woon-werk Onbelast (Non-Taxable Commuting Cost)

A travel allowance for commuting between home and work. This is tax-free up to a certain limit set by the Dutch tax authority.

35. Nettoloon (Net Salary)

The amount you actually receive in your bank account after all taxes and deductions. It’s calculated as: Gross income – Taxes – Social contributions + Non-taxable reimbursements

36. Specificatie (Specification)

A label or note explaining the nature of a payment or deduction, such as “holiday allowance” or “travel reimbursement.”

37. Opbouw (Accumulated in the Period)

Shows how much has been accrued for a specific component (e.g., vacation days, allowances) during this pay period.

38. T/m Periode (Accumulated Year-to-Date)

Displays the total amount accumulated from the start of the calendar year up to this payslip’s period, useful for tracking your income, taxes, and pension over time.

d. Payment Details

After all the calculations—your gross pay, deductions, and any reimbursements—this final section shows the net amount that will be transferred to your bank account. It’s the most straightforward part of the payslip, but also the most important for many employees: it tells you exactly how much you’ll receive and to which account.

39. Uit te betalen (To Pay Out)

This is your final net salary for the period—what will actually be deposited into your bank account.

40. Net salary to pay out to bank account

41. IBAN / Bankrekeningnummer (Bank Account Number)

The International Bank Account Number (IBAN) where your salary will be paid. Make sure this is correct to avoid payment delays.

e. Cumulative & Technical Payroll Details

This section of your payslip gives an overview of your totals over time, such as how many hours you’ve worked, how much vacation you’ve built up, and how much has been accumulated for bonuses or social contributions.

While some terms here may seem technical or less familiar, they help provide full transparency about your salary, benefits, and tax situation.

42. Cumulaties – Totals accumulated during the year or contract period, like wages, hours, or benefits.

43. Uren gewerkt – The number of hours you worked in the current period.

44. Uren vakantie – Vacation hours accrued or used in this period.

45. Saldo Vak (Wet) – Your statutory vacation balance under Dutch labor law (based on a minimum of four times your weekly working hours).

46. Uren onregelmatig 150% – Overtime hours worked during irregular times (like nights or weekends), compensated at 150% pay.

47. Saldo Vak (Boven Wet) – This refers to extra vacation hours above the statutory minimum, often granted by collective labor agreements (CAOs) or company policies. These are additional days off beyond the basic legal entitlement.

48. Deeltijdfactor – Your FTE (full-time equivalent) percentage. For example, 0.6 = 60% of a full-time schedule.

49. Opgebouwd vakantie toeslag – The amount of vacation allowance accrued since May of the previous year, shown in hours and in euros.

50. Deeltijd vakantie % – Your FTE-based percentage used to calculate how much vacation time you accrue.

51. Mutatie Eindejaarsuitkering – This indicates a change or adjustment to your end-of-year bonus (eindejaarsuitkering) during the current payroll period. This could reflect a correction, early payout, or partial accrual update.

52. Opgebouwd eindejaarsuitkering – The end-of-year bonus you’ve built up so far (in hours and euros), usually paid in December.

53. Deeltijd eindejaar uit % – This represents the FTE percentage used to calculate your end-of-year bonus (eindejaarsuitkering). If you’re working part-time, your bonus is prorated based on this percentage.

54. Arbeidskorting – This is the labour tax discount, a tax credit applied to reduce the amount of income tax for working individuals.

55. Grond sociale premies OP/NP – Taxable base salary used to calculate pension premiums (OP = old-age pension, NP = survivor’s pension).

56. Grond sociale premies Overige Maatregelen – Tax base for miscellaneous social contribution measures.

57. Grond sociale premies RAS – Tax base used to calculate contributions to industry-specific union funds (e.g., RAS for cleaning or construction).

58. Grond sociale premies PAWW – Taxable base used to calculate contributions for the PAWW (private top-up unemployment scheme).

59. Grond sociale premies Afdeling NP/OP – Other base salaries considered for pension-related contributions (a subdivision of the pension base).

60. Wg Heffing ZVW (Zorgverzekeringswet) – Employer’s contribution under the Dutch Health Insurance Act (ZVW). This is a mandatory part of payroll taxes.

61. Voorheen sociaalplichtig loon – Your previous salary that was subject to social contributions, useful for reference or recalculations.

62. Uurloon – Your gross hourly wage, useful if you’re paid by the hour or working part-time/on-call.

63. Premie PAWW – Percentage of salary deducted for the PAWW top-up unemployment benefit.

Tips for checking your payslip

Understanding your payslip isn’t just about knowing what you earn — it’s also about ensuring everything is accurate. Here are a few essential tips to help you confidently review your Dutch payslip each period:

a. Compare gross vs. Net

Your bruto (gross) salary is your total earnings before any deductions. The netto (net) amount is what actually lands in your bank account. A clear difference is normal, but you should always:

– Check whether the deductions (taxes, pension, insurances) seem reasonable.

– If your net salary fluctuates without explanation, look for variable components like overtime, allowances, or tax adjustments.

b. Verify deductions match your tax bracket

Make sure:

The Loonheffing % (Payroll Tax Rate) aligns with your income level.

If you have multiple jobs, ensure the loonheffingskorting (tax credit) is only applied at one job — applying it twice can result in a tax bill later.

Check that pension contributions and social security premiums are included and seem accurate.

c. Monitor your leave days

Vacation and leave entitlements are clearly tracked on Dutch payslips:

Keep an eye on your vakantie-uren (vacation hours) and saldo vak (vacation balance).

Note if there’s a separate entry for boventallig (extra statutory) vacation days.

This helps prevent misunderstandings or shortfalls when planning holidays.

d. Found a mistake? Take action

Payslip errors do happen — from miscalculated hours to missing allowances or wrong tax credits. If something looks off:

Contact your HR department or payroll administrator as soon as possible.

Be specific about what seems incorrect and have a previous payslip handy for comparison.

The sooner you raise it, the easier it is to fix it in the current or next pay cycle.

Useful tools & resources

Payslips can be complex — especially when you’re working in a new country. Fortunately, there are tools and services available to help you make sense of your salary and deductions.

Try a Dutch salary calculator to estimate your net income, tax deductions, or verify if your employer’s calculations are accurate. A reliable tool like Loonwijzer.nl – Nettoloon berekenen allows you to convert gross to net salary, explore how adjustments in working hours, tax credits, or benefits impact your take-home pay, and understand the effects of pension and insurance deductions.

Additionally, save your payslips by keeping a digital or printed copy of each one, as they are essential for tax filings, mortgage or loan applications, and when changing jobs. In case of any disputes regarding your salary, benefits, or employment history, payslips serve as your most reliable proof.

Coach4expats: We’re Here to Help

Navigating a Dutch payslip can feel overwhelming at first — but once you understand the structure and terminology, it becomes a powerful tool for managing your finances. From checking your tax deductions to tracking your vacation pay and bonuses, your payslip offers valuable insight into your employment rights and financial well-being.

Here’s how we support you:

– Payslip reviews — We help you check your payslip for accuracy and ensure you’re receiving the benefits you’re entitled to.

– 1:1 consultations — Got questions about taxes, holiday pay, or end-of-year bonuses? We’re just a message away.

– Support with HR or payroll disputes — We can help you frame the right questions and follow up with your employer.

– Workshops and webinars — Learn how Dutch payroll, taxes, and benefits work in real-life situations, join our premium community to have FREE access to all our events.

Don’t guess — get clarity. If you’re unsure about something on your payslip or need help with Dutch payroll terms, reach out to us at Coach4expats and book a consultation. We’re here to make your Dutch work life easier — one payslip at a time.